Episode 4Don’t Interrupt the Incredible Power of Compounding

Compounding good returns for as long as possible can yield mind-boggling results. Be patient. Think long term.

Share this Video

Transcript

| Speaker | Timestamp | Statement |

|---|---|---|

| Chris Davis | 00:00 | Morgan, in all of these years of trying to get across to investors the fundamental, deep building blocks of investing, I think one of the hardest is the power of compounding, and the miracle of it. We all try to come up with examples that will show the doubling of the penny for 30 days. But somehow it just can't get into people's minds how incredibly powerful the nature of compounding is. And I'm curious if you have a way to describe that or to conceptualize it that can get into people's brains more successfully than I've been able to do. |

| Morgan Housel | 00:43 | Well, I would first say, Chris, if I were to say, "What is eight plus eight plus eight plus eight?," you could figure that out in 5, 10 seconds. That's not a problem. That's basic math. But if I said, "What is eight times eight times eight times eight times eight?," your head's going to explode. We are not wired for that kind of compound growth. We are so much more wired for linear thinking. And that's true for every endeavor in our life. And it's why we underestimate the power of compounding. |

| Morgan Housel | 01:09 | The story that I used in the book that to me was the most incredible example that I had come across of compounding in nature, is that there have been five ice ages in the history of this planet. We've known about them for a long time. And it was thought, for hundreds of years, by geologists, that the cause of those ice ages would be, we've always known that there are subtle shifts in the earth axis that would push us closer, further away from the sun. And it was always assumed that the cause was winters would become viciously cold throughout the universe or throughout the planet and would turn the planet into a giant ice cube. |

| Morgan Housel | 01:41 | It was about a hundred years ago that a geologist figured out that it was actually the opposite thing occurring, that the actual cause that started a new ice age was not viciously cold winters. It started with a moderately cool summer, when the winter snow from the previous winter did not melt. And so, you started the next season with a snow base from the previous year. That let more snow pile on top of it. And it just kind of ran wild from there. |

| Morgan Housel | 02:07 | The power of it was, you do not need a viciously cold, powerful winter to create a new ice age. All you need is a moderately cool summer where you have a base that lets things pile on top of it. This tiny little, not that powerful force is what created the most powerful force that turned the earth into a giant ice cube. You don't need that much power to get it going. |

| Morgan Housel | 02:30 | And I think that's true for finance, as well. Compounding is so counterintuitive that it's easy to look at someone like Warren Buffet and think he's worth a hundred billion dollars, that must have been the most powerful force and the most brute force intelligence to get to that point. But if you actually dissect his biography in the course of his life, you'll see that 99% of his net worth was accumulated after his 50th birthday, 98% something in that range was accumulated after his 65th birthday. That's just how compounding works. |

| Morgan Housel | 03:00 | And I think the thing that's interesting about Buffet is that, if Buffet had retired at age 60, like a normal person might, you would've never heard of him. He never would've become a household name. He never would've accumulated a fraction of what he has. Is he a good investor, like we talked about earlier? Yes, of course, he's a good investor. He's one of the best. But the whole secret is that he's been a good investor for 80 years. And that number is the exponent in the equation that does all the heavy lifting. |

| Morgan Housel | 03:25 | And that's what's just not intuitive for people to think about for investing, that it's not necessarily the returns that you earn. It's, how long are you going to earn those returns for. And all of the effort, all the brain power in this industry goes towards, how can I earn higher returns? Which I understand that. It's important. I don't want to poo-poo it. But all of the wealth in the industry comes from, what are the returns that I can earn for the longest period of time? All the effort is on the base number, and all of the wealth is on the exponent. So, I think that's what's just not intuitive and it makes all the difference in the world. |

| Chris Davis | 03:58 | And of course it creates this struggle, which is getting people to start earlier, is such a powerful multiplier of their returns starting at 20 instead of 30, starting at 30 instead of 40. And so, people think of those last years, can I stay invested longer instead of thinking of the first years, can I start? And of course the nature of how we think about time and how our brains evolve make it very hard for a 20-year-old to ever imagine that they're going to be 65 or 70. |

| Chris Davis | 04:28 | And I think Buffet's description of the snowball down the hill is a good way for people to think about it, where he said, ultimately people are focused on the slope of the hill. The steeper it is, the faster that snowball will build. But, really what matters is the length of the hill. It's not the slope, it's the length. |

| Chris Davis | 04:51 | And my grandfather, it's a true story, people think it's apocryphal, but it is true that when I worked for him one summer, I was 13, and we were walking back from a meeting. His office was on pine street. And we're right around lunchtime. And I asked him if he would give me a dollar for a hot dog, because I was hungry and it was lunchtime. We usually brown bagged it. That was part of his frugality. |

| Morgan Housel | 05:19 | Yeah. |

| Chris Davis | 05:19 | And he stopped and he took this moment to explain compounding by saying that, if I saved and invested that dollar and I lived as long as he did that, and I compounded at the rate that he had, that the dollar would be worth a thousand dollars. |

| Morgan Housel | 05:33 | Yeah. |

| Chris Davis | 05:34 | And he said, "Is a hot dog worth a thousand dollars?" And of course it taught me about compounding. It taught me about the value of a dollar, and the other side, the idea of purchasing power degrading over time. But it also taught me a little bit about independence and carrying my own money. |

| Chris Davis | 05:56 | And so, I like to say that hotdog story was the way that I got compounding as a 13 year old. But I just think it is the most important concept for a parent to get a child, an advisor to get a client, an investor to think about as they buy businesses, is the length of the hill, the length of the time, the exponent, not the rate. |

| Morgan Housel | 06:17 | Makes all the difference. |

| Chris Davis | 06:18 | Yeah. |

Chris & Morgan Bios

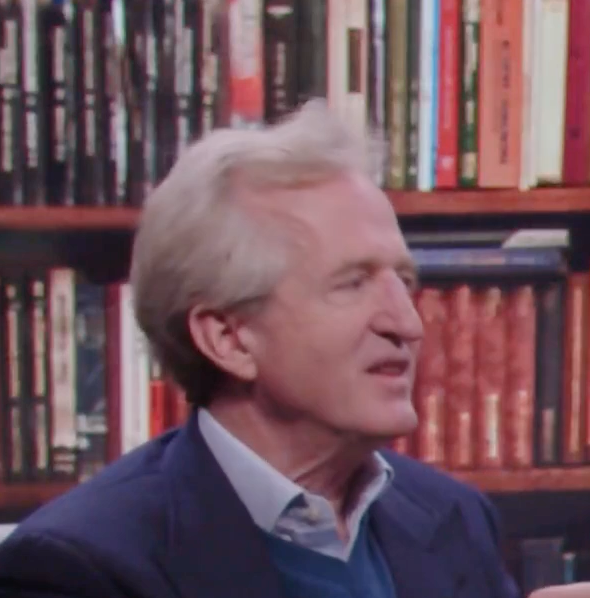

Chris Davis

Chris is Chairman of Davis Advisors, an independent investment management firm founded in 1969 with approximately $26 billion in AUM. As of 9/30/24 He’s co-portfolio manager of the Davis NY Venture Fund as well as other portfolios focused on Large Cap and Financial companies across mutual funds, SMAs and ETFs. Chris has over three decades of experience in investment management and securities research, was recognized as a Morningstar Manager of the Year and sits on the Board of Directors for Berkshire Hathaway.

Morgan Housel

Morgan is a partner at The Collaborative Fund and serves on the board of directors at Markel Corp. His book The Psychology of Money has sold over two million copies and has been translated into 49 languages. He’s won multiple awards and accolades for his writing and insights from the Society of American Business Editors and Writers, the New York Times, and other industry organizations. Morgan has presented at more than 100 conferences in a dozen countries.