Mastering the Mental Game of Investing

A video series to help you develop the mindset of a successful investor.

How you think and behave when investing is as important as what you own. Chris Davis (Portfolio Manager) and Morgan Housel (best-selling author of The Psychology of Money), share strategies to help you gain a mental edge.

Mindset & Behaviors of Successful Investors

The Video Series

Mindset & Behaviors of Successful Investors

The Video Series

Share this Video Series

The Video Series

Episode 1

Episode 1

You Make Most of Your Money in a Bear Market – You Just Don’t Realize it at the Time

Historically, market corrections have ultimately been followed by new highs. This is why we believe the savvy long-term investor views a correction as an opportunity to buy stocks at lower prices.

(7:14) Episode 2

Episode 2

Expect Market Volatility While Building Wealth

Market corrections are painful yet inevitable. Understanding this can help you stay invested to benefit from the power of compounding.

(3:27) Episode 3

Episode 3

Disregard Short-Term Forecasts

Forecasts from market prognosticators have no predictive value. Don’t let them influence your decisions. Stay focused on your investment plan.

(7:30) Episode 4

Episode 4

Don’t Interrupt the Incredible Power of Compounding

Compounding good returns for as long as possible can yield mind-boggling results. Be patient. Think long term.

(6:24) Episode 5

Episode 5

Save Like a Pessimist, Invest Like an Optimist

Save enough to weather short term uncertainty, but be optimistic enough to take advantage of the incredible wealth-building power of equities over time.

(10:06) Episode 6

Episode 6

Invest to Gain Freedom

Why invest? To have the freedom to do what you want, when you want, with whom you want, for as long as you want.

(7:07) Episode 7

Episode 7

Saving is as Important as Investing

Avoiding "lifestyle bloat" can be as important as generating good returns when building wealth.

(7:41) Episode 8

Episode 8

Invest Systematically Regardless of Market Conditions

A habit of investing regularly takes the guesswork out of when to invest, and enables you to capitalize on short term market declines.

(6:10) Episode 9

Episode 9

Pulling It All Together – Mastering the Mental Game of Investing

Concise review of the most critical insight of this series: Your mindset and behaviors towards investing, spending and volatility can determine whether you reach your goals.

(5:51)Chris & Morgan Bios

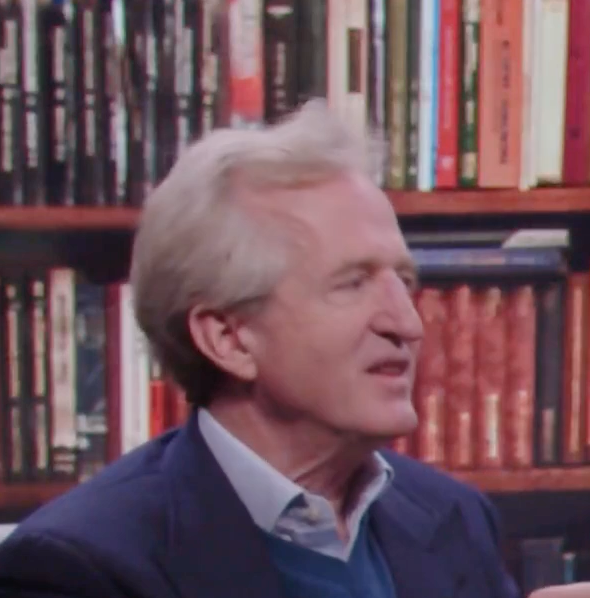

Chris Davis

Chris is Chairman of Davis Advisors, an independent investment management firm founded in 1969 with approximately $26 billion in AUM. As of 9/30/24 He’s co-portfolio manager of the Davis NY Venture Fund as well as other portfolios focused on Large Cap and Financial companies across mutual funds, SMAs and ETFs. Chris has over three decades of experience in investment management and securities research, was recognized as a Morningstar Manager of the Year and sits on the Board of Directors for Berkshire Hathaway.

Morgan Housel

Morgan is a partner at The Collaborative Fund and serves on the board of directors at Markel Corp. His book The Psychology of Money has sold over two million copies and has been translated into 49 languages. He’s won multiple awards and accolades for his writing and insights from the Society of American Business Editors and Writers, the New York Times, and other industry organizations. Morgan has presented at more than 100 conferences in a dozen countries.