Video

Investing through Volatility

PM Chris Davis on developing a mindset that allows you to tune out the daily drama and successfully build wealth.

Education

“The stock market is a device to transfer money from the ‘impatient’ to the ‘patient’.”

Warren Buffett, Chairman, Berkshire Hathaway

Education

The Wisdom of Great Investors

History’s greatest investors share some of their best advice on building wealth

Education

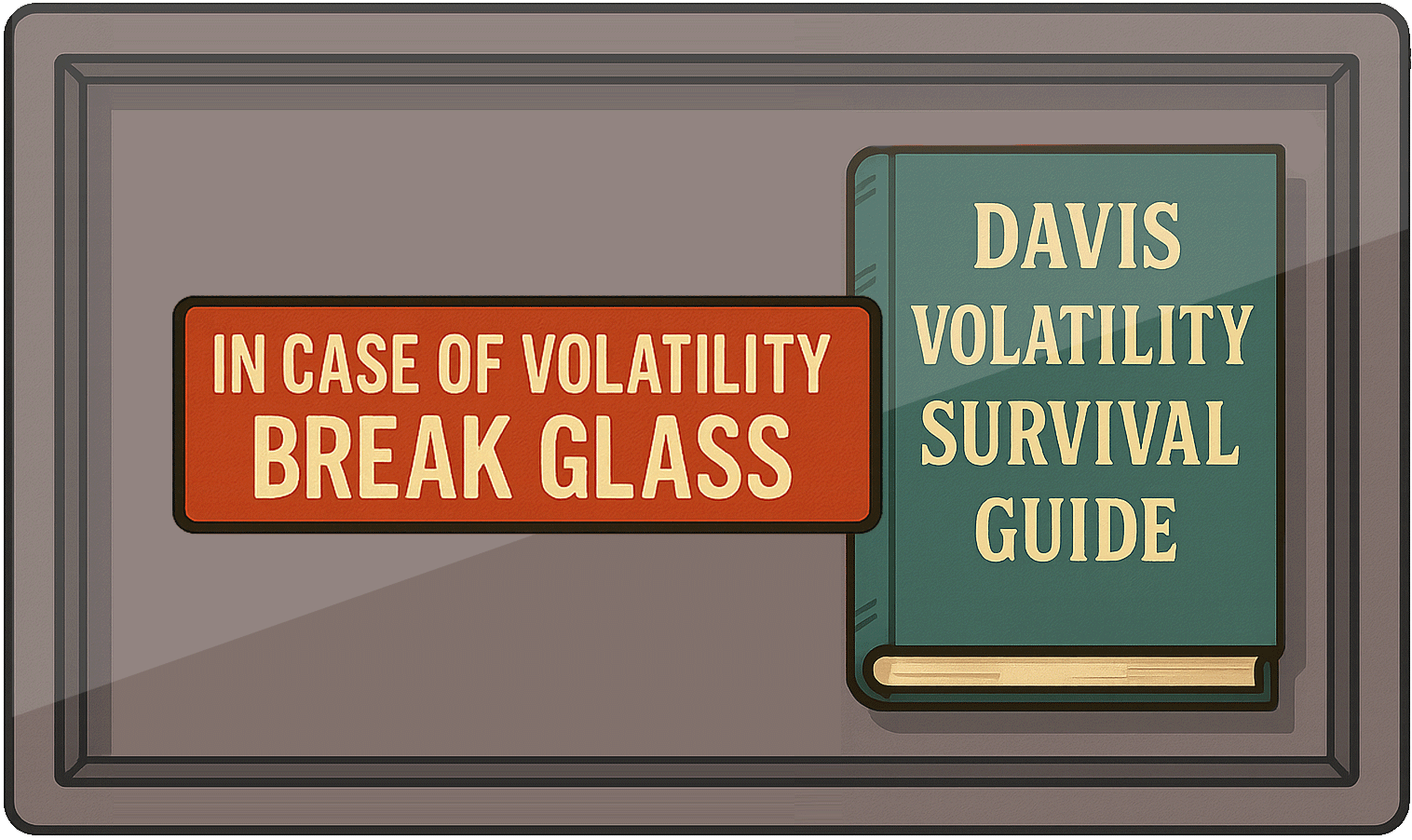

Davis Volatility Survival Guide

An illustrated guide to help tune out the noise, make sense of the volatility and build long-term wealth

Other Ways to Invest

Our Mission

For more than half a century, helping investors reach their financial goals through rigorous research, uncommon stewardship and long term results.

Portfolios, Factsheets & Commentaries

| Portfolio | Factsheet | Portfolio Manager Commentary |

|---|---|---|

| Large Cap Value SMA Portfolio | ||

| All-Cap SMA Portfolio | ||

| International ADR SMA Portfolio | ||

| Global ADR SMA Portfolio |