Episode 6Invest to Gain Freedom

Why invest? To have the freedom to do what you want, when you want, with whom you want, for as long as you want.

Share this Video

Transcript

| Speaker | Timestamp | Statement |

|---|---|---|

| Chris Davis | 00:00 | ... for most individual investors and really for most humans, we can talk about financial risk in all sorts of esoteric terms about volatility, about time horizon. But for most people, risk is about becoming dependent. The risk is the idea of having to modify your lifestyle in a way that your kids may live worse than you did, or where you become beholden, you become dependent on loved ones, you become dependent on the government. You lose your freedom. And I am so struck in your writing, by the way, you talk about wealth in terms of freedom, rather than in terms of possession. So I was really hoping you could spend some time unpacking the idea of freedom and what that means? |

| Morgan Housel | 00:52 | Well, I think a lot of this is if you want to be happier with your money, let's use that as a goal. You want more money, so you can have a happier life. Most of happiness is not increasing how happy you are, it's decreasing how miserable you are. That's the nuance of it that's really important. It's not that the happiest people are very happy, it's that they tend to have fewer bad days than other people. That's the best that we can aim for. So then if the question is, it's not about adding happiness, how can I remove unhappiness? What makes people unhappy? |

| Morgan Housel | 01:23 | A lot of it, and this is generalizing, but a lot of it is dependence on others, dependence on their boss, dependence on their company, dependence on somebody else's goals and motivations that you are linked to, whether you like it or not. |

| Morgan Housel | 01:36 | Your boss tells you need to be at your desk at 9:00 AM doing X, Y, and Z, whether you like it or not. You are dependent on that schedule. And a lot of removing that and just being able to do what you want, when you want, for as long as you want, is going to remove the most amount of unhappiness in your life. And therefore has the best shot at actually making you happier. There's this great story that I like from FDR, who, when he was a child, he told his mom, I think he was about five years old. He said, "My life is just completely dictated by rules. And I don't like these rules." |

| Morgan Housel | 02:06 | So Sarah Roosevelt, his mother said, "Okay, little Frankie Roosevelt. Tomorrow, you can do anything you want. The day is yours, whatever you want to do, you go and do it." She wrote in her diary later that night, the next day, that even though the day was his own, he did his normal routine like he would normally do at the same schedule that he would normally do. So doing something on your own terms that you want to do, even if you're doing the exact same thing, feels so much better than if someone is telling you to do it. |

| Morgan Housel | 02:33 | And I think for a lot of people who are financially independent, they don't have to work, but they still go to work because they want to do it. They like working with other people. They like being productive, but when you have to do it, because your boss is telling you to do it and you depend on that, that's a completely different ballgame. And I think if we can use wealth, not just for nicer stuff, not just for the bigger house and the flashy car and whatnot, but if you can use it for a level of independence, so that you can just wake up every morning and say, "I can do whatever I want today." |

| Morgan Housel | 03:02 | Even if what you want to do is go to work and work as hard as you can. Even if that's what you want to do, doing it on your own terms, completely changes the game. A big area for me, where I started thinking about this was my father was an ER doctor. Which I think is one of the most stressful professions you can have, people literally dying in your arms every single shift. And he did it for about 25 years and one day, not that long ago, within the last 10 years or so, he woke up and he said, "I'm done. I'm proud of my career. I enjoyed my career, but I've had enough. Thank you. Goodbye." And he walked out and that was it. That was his retirement. |

| Morgan Housel | 03:36 | And a lot of his peers who spent a lot more money than him and had a bigger house than we did and better cars than we did, could not do that. They were just as burnt out and tired, at age 65, as my father was, but they had to keep going. And my dad, the moment he was done, the moment he stopped enjoying it and he said, "I'm out." And that's when I realized the value of his frugality. I used to look down upon my parents for their frugality. And I used to think when I was a teenager, I said, "I know how much money you guys make. We could have a much nicer house. We could go on much nicer vacations, but we don't. And I look down upon you for that." |

| Morgan Housel | 04:08 | And the moment that my father retired when he wanted to, it was like, "I get it now. Your wealth was independence to do what you want, when you want. And that wealth is going to give you so much more happiness than the bigger car or the bigger house ever would." That's all I've ever wanted out of money and wealth and savings is not necessarily nicer stuff. Although, I like nice stuff as much as anyone else. I just want to wake up every morning and say, "This day is mine, it's not anyone else's, I control this day." And I think if I can do that, that's using wealth to gain happiness better than any other way I can. |

| Chris Davis | 04:42 | Well, in the aspirational aspect of that, I think it's part of what's powerful about how you've articulated and conceptualized it. Because, to me, it was always about freedom from fear. |

| Morgan Housel | 04:56 | No. |

| Chris Davis | 04:57 | So I thought... And this is something I wish on my children. I want to be able to do whatever I can to reduce the fear that comes from financial causes. The fear that I'm one medical incident away from poverty. People live with that fear that comes from financial insecurity. So I was articulating it in terms of reducing fear. Reducing the things that you need to be afraid of, because there's a lot of scary things in the world anyway. But to the extent that somebody is afraid of losing their job, because they couldn't pay the rent or afraid of somebody getting sick because they can't afford the insurance. |

| Chris Davis | And so I always thought of it in those negative terms, freedom from fear. And what you've done is, I think you've helped people see it aspirationally, rather than... And it matters because especially with young people, young people, they're not governed by fear. | |

| Morgan Housel | 05:56 | Yeah. |

| Chris Davis | 05:57 | They're governed by the sense that they're all powerful and immortal and in some ways statistically they are. And so fear is a very poor motivator to a 25 year old. Whereas freedom is a very powerful motivator for a 25 year old. So if nothing else, just the service of reconceptualizing that is one of the most valuable things in your book, in your work. |

| Morgan Housel | 06:20 | Well, thank you. And a lot of this, too, it's almost cliche to say to people, "Don't spend your money on stuff, spend it on experiences." |

| Chris Davis | 06:27 | Yeah. |

| Morgan Housel | 06:27 | And I think everyone says that and I think it can still get it wrong, because a lot of experiences you're doing for other people. You're doing it for the Instagram photo, you're doing it because you want to tell your friends that you vacation in the Hamptons, whatever it might be. You're doing it for them. True independence and freedom, to me, is you're just doing it for the internal benchmarks. You're just doing it for yourself. |

| Morgan Housel | 06:46 | And dependence on other people's view of you is dependence. It's a special form of slavery to their opinions and in their view of you. I think you're really only independent when you can use your money to do what you want to do, for as long as you want to do. |

Chris & Morgan Bios

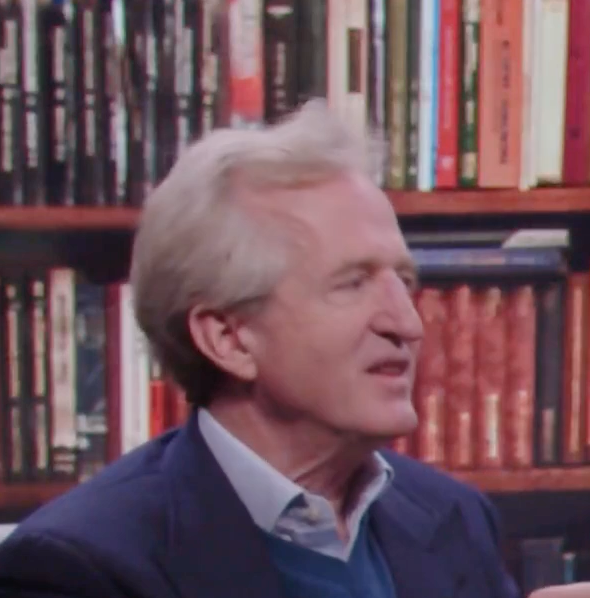

Chris Davis

Chris is Chairman of Davis Advisors, an independent investment management firm founded in 1969 with approximately $26 billion in AUM. As of 9/30/24 He’s co-portfolio manager of the Davis NY Venture Fund as well as other portfolios focused on Large Cap and Financial companies across mutual funds, SMAs and ETFs. Chris has over three decades of experience in investment management and securities research, was recognized as a Morningstar Manager of the Year and sits on the Board of Directors for Berkshire Hathaway.

Morgan Housel

Morgan is a partner at The Collaborative Fund and serves on the board of directors at Markel Corp. His book The Psychology of Money has sold over two million copies and has been translated into 49 languages. He’s won multiple awards and accolades for his writing and insights from the Society of American Business Editors and Writers, the New York Times, and other industry organizations. Morgan has presented at more than 100 conferences in a dozen countries.