The most common and damaging investor penalty comes from rushing in at euphoric high prices and panic selling at the lows. Here's a real alternative.

Transcript

| Speaker | Timestamp | Statement |

|---|---|---|

| Chris Davis | The most important risk is really the one that's most manageable. And that's the investor behavior. What we realize is that one of the certain costs that investors bear every year is the timing and selection penalty. It's when they get in and when they get out. When prices go up, they get excited and want to pile in. When prices go down, they get fearful and want to get out. So really, in a sense, the return that an investor gets is the product of two different variables. | |

| One is the underlying return of the investments, but the second one is what we call investor behavior, the timing of when they get into those investments, or when they're shaken out of them. And so when you think about ways to mitigate that investor behavior penalty, one of the most important ways is to manage expectations. You have to have realistic expectations. My mentor Charlie Munger used to say, the secret to a happy marriage is low expectations. So you need to get in with an awareness of what is a realistic expectation. You know, it's 7, 8, 9%. | ||

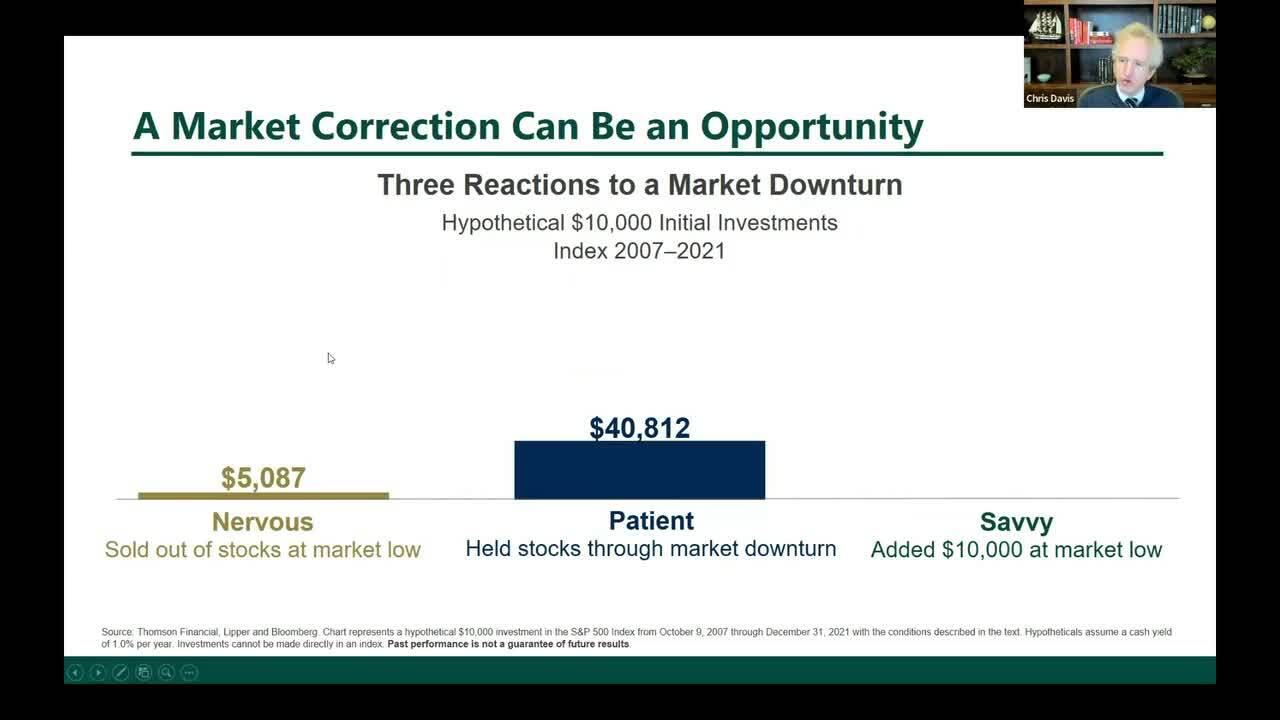

| Look at history as sort of a guide of what long-term returns should be and manage expectations around that. That. The second thing to think about is the inevitability of corrections, the inevitability of shocks and disruptions in the system. The market is going to dip 20 percent on average every three years. It's just an unpleasant but inevitable part of the landscape. Set your expectations for those corrections. The third is, can you disregard short-term forecasts? Yes. It is amazing. You can't turn on the TV without hearing, you know, this strategist comes out and says, the market is going to go down. Another one comes out and says, no, it's going to come out. It's a great time to get in. What about the election? What if the Democrats win? What if there are, These are all important questions, but they are unknowable. So you have to prepare, but you can't predict the outcome. So, reacting to short-term forecasts about interest rates, about monetary policy, about politics is a very, very dangerous thing. And I think maybe the most important thing is to try to have the discipline to invest relentlessly and systematically. | ||

| You know, Mayor LaGuardia stood in front of the lions on the steps of the New York Public Library in the depths of the Depression, and he named those two lions Courage and Fortitude. And I think those lines of the lion's investors need to maintain courage and fortitude to stick with your investment plan. So if that means systematically investing over time, that's a wonderful way to mitigate investor behavior penalties. You just average in relentlessly over time. But really the truth is, if you look at the compelling data, whether you get in at the high of the year or the low of the year, whether you average in every month or just get in at the beginning of each year, over time, those differences are relatively modest compared to how much it matters that you got in. So the key is to have the courage and the fortitude to get started and then to stick with it when those inevitable, fearful times, those inevitable panics, those times of dislocation when those come to have the courage and fortitude to stick with your long-term plan. |

Related Videos

Video

Volatility is the Price of Admission for Long-Term Returns

To benefit from the wealth-building potential of equities, investors need to understand that pullbacks and drama will be an inevitable part of the journey.

Video

The Incredible Value Advisors Can Add During Volatile Markets

How the guidance of a financial advisor can help investors successfully build wealth as they navigate inevitable market volatility.