Why the best-run Financials continue to be significantly undervalued, as investors misunderstand their durability and earnings power

Transcript

| Speaker | Timestamp | Statement |

|---|---|---|

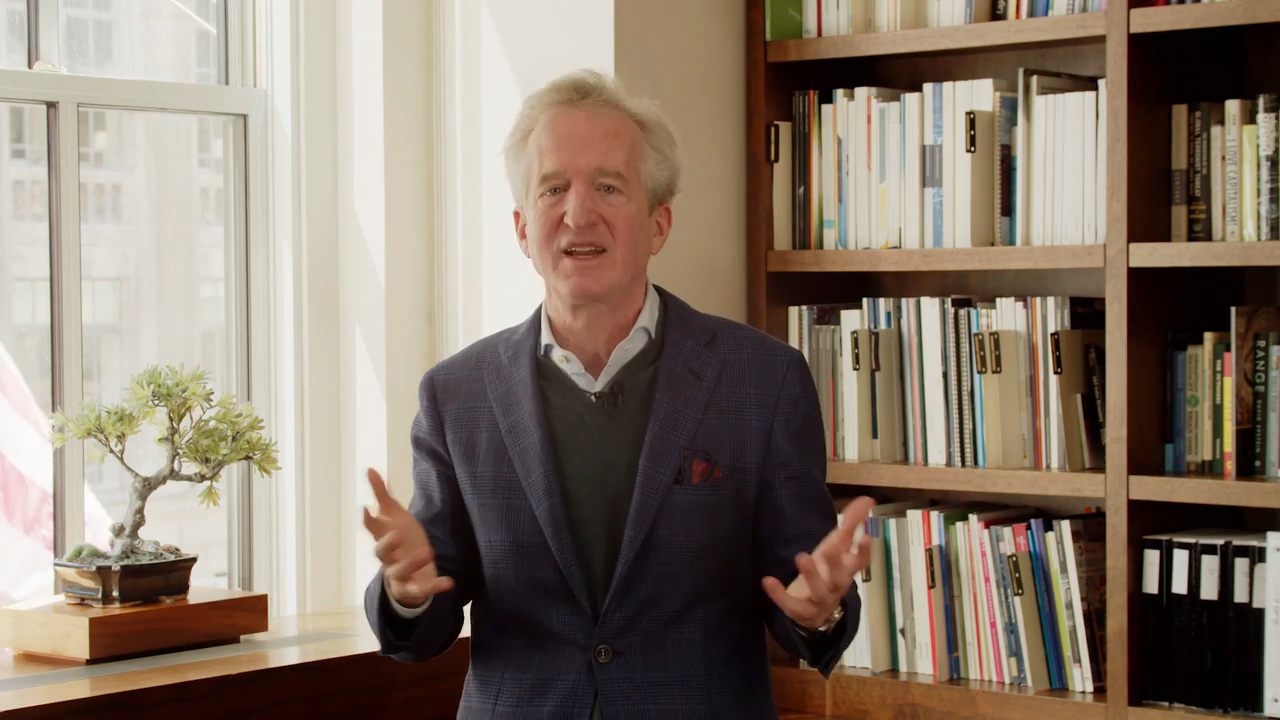

| Chris Davis | One of the most persuasive themes that we see in today's market is in a sector that people perceive as being filled with risk, and that's the financial services sector. Now, before I dive more deeply into it, I should give a general statement that says, first of all, that when people hear financial services, what they think is banks. And of course financial services is a far more broad industry than that. It can include banks, of course, but they're all different types of banks, but it also includes insurance companies, property, casualty companies, companies in credit cards, companies that have real estate exposure, companies that are prone or vulnerable to weather events, companies that are indifferent to weather event It's a massive industry, but what you know is that everybody in this country is a customer. So it's a vast industry, and it's an industry where wealth can be built by being very specific And that is one of the key criterias. With financial services, you get an enormous dispersion of returns. Now, let us take those general thoughts and narrow it down to the opportunity and the risks that we see priced into the market today. The first and most important one is that this is a durable industry with proven durable companies that people view as constantly vulnerable to enormous risk. So, people remember the financial crisis. They remember the banks that failed, but they don't recognize that the banks that navigated those waters prudently, not only grew substantially as a result of the demise of their competitors, but today are actually capitalized at almost twice the rate of capital that they had before the financial crisis. So, you've ended up with a more conservative industry that is better capitalized, is more durable with less risk and yet those old perceptions that it somehow is a teetering industry create an opportunity of very low valuations. So let's run through the sorts of risks and arrows that get on people's minds. We certainly think about credit risk, right? People see the empty office buildings and they think, oh, what about the SNL crisis when you have a look through empty buildings? Well, what's amazing is how well positioned the banks are in terms of credit in part because of the financial crisis, the regulatory environment change, they not only put up more capital with more conservative accounting, they actually have taken less credit risk relative to their asset portfolio. So they have been able to roll through things like COVID and retail and they will roll through the office-based downturns and other types of credit risk simply because of the way these balance sheets are positioned now. Now, second, people think about interest rate risk. And of course, you saw when interest rates moved up, you saw companies that had positioned very aggressively and very irresponsibly. So the interest rate risk is knowable, it is in the data. the credit risk, the capitals. What about liquidity? Again, the focus on core deposits on companies that have enormously diverse funding basis, technology risk, regulatory risk. All of these things are sort of the changing landscape of risk, and yet the best position and the best managed companies have been able to grow straight through this. And if I think about their proven resilience At a time when many of them are trading at single digit or low double digit multiple. So 50% discounts to the market. We think that is a powerful combination. We think of it as mispriced and misperceived durability. That's a wonderful combination. |

Related Videos

Video

Investing through Volatility

PM Chris Davis on developing a mindset that allows you to tune out the daily drama and successfully build wealth.