Key Takeaways

- Davis Large Cap Value SMA outperformed the Russell 1000 Value Index in 2025 by a large margin, returning +21.65% versus the index’s +15.91% return.

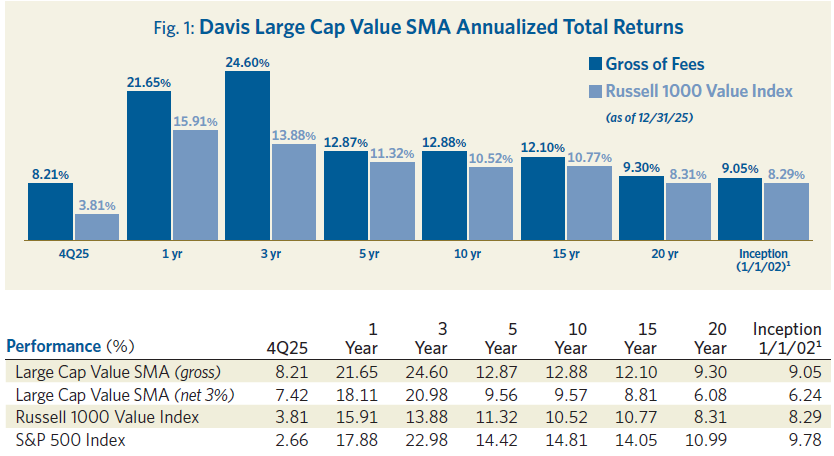

- The strategy outperformed the Russell 1000 Value Index over the trailing 1-, 3-, 5-, 10-, 15-, 20-year periods and since inception (see Figure 1).

- The strategy outperformed the S&P 500 Index over the trailing 1- and 3-year periods and since inception.

- The U.S. stock market had its third consecutive year of double-digit returns in 2025—it has shown notable resilience but is also trading at a high valuation and at the most extreme level of concentration in almost three decades.

- In this market environment we believe it is critical for a portfolio manager to be active, selective and flexible, and we are advising clients to decrease exposure to the passive indexes and their stretched valuations.

- We believe the Davis Large Cap Value SMA portfolio is well-positioned to continue delivering superior earnings growth while trading at a steep discount to the benchmark.

Net Average Annual Total returns as of December 31, 2025, for Davis Large Cap Value SMA Composite with a 3% maximum wrap fee: 1 year, 18.11%; 5 years, 9.56%; 10 years, 9.57%. The performance presented represents past performance and is not a guarantee of future results. Total return assumes reinvestment of dividends. Investment return and principal value will vary so that an investor may lose money. For current, quarterly returns, please ask your financial advisor to contact Davis Advisors. Current performance may be higher or lower. The investment strategies described herein are those of Davis Advisors. These materials are being provided for illustrative and informational purposes only. The information contained herein is obtained from multiple sources that are believed to be reliable. However, such information has not been verified, and may be different from the information included in documents and materials created by the sponsor firm in whose investment program a client participates. Some sponsor firms may require that these materials are preceded or accompanied by investment profiles or other documents or materials prepared by such sponsor firms, which will be provided upon a client’s request. For additional information, documents and/or materials, please speak to your Financial Advisor. Davis Advisors fee schedules are described in Part 2 of its Form ADV. The strategies herein may not be suitable or appropriate for all investors depending on their specific investment objectives and financial situation. Potential investors should consult with their financial professional before determining whether to invest in a strategy.

This material includes candid statements and observations regarding investment strategies, individual securities, and economic and market conditions; however, there is no guarantee that these statements, opinions or forecasts will prove to be correct. Equity markets are volatile and an investor may lose money. Past performance is not a guarantee of future results. Unless otherwise noted, all performance information is as of 12/31/25. The investment strategies described herein are those of Davis Advisors. These materials are being provided for illustrative and informational purposes only. The information contained herein is obtained from multiple sources that are believed to be reliable. However, such information has not been verified, and may be different from the information included in documents and materials created by the sponsor firm in whose investment program a client participates. Some sponsor firms may require that these Davis Advisors materials are preceded or accompanied by investment profiles or other documents or materials prepared by such sponsor firms, which will be provided upon a client’s request. For additional information, documents and/or materials, please speak to your Financial Advisor.

Market Perspectives:

Spotlight on Active Management

In 2025 the U.S. stock market achieved its third consecutive year of double-digit returns in rather broad-based fashion but led primarily by technology stocks. The market’s resilience in the face of major economic, geopolitical and technological shifts is noteworthy. However, the S&P 500 Index, which many view as a proxy for U.S. stocks in general, is trading at a relatively high valuation with a forward price-to-earnings (P/E) multiple of 26 times. Furthermore, the index is more concentrated today in its top 10 holdings than we have seen since the bubble of the late 1990s with approximately 40% of its value residing in 10 megacap names, almost all of which are technology-driven companies.

The Russell 1000 Value Index, which, alongside the S&P 500 Index, is a benchmark for Davis Large Cap Value SMA, is trading at a lofty 20 times earnings and has delivered far lower earnings per share growth than our portfolio or the S&P 500 Index over the past five years. In its current configuration, the Russell 1000 Value Index strikes us as relatively unattractive.

We believe that active management is an appropriate solution in today’s market environment. It gives a portfolio manager the flexibility to be highly selective at the security level and maintain rational diversification through consciously determined position weightings and sector composition. Put simply, we are advising clients to decrease their exposure to the stretched valuations of the passive indexes and reallocate to actively managed equity portfolios run by seasoned and proven managers.

Looking ahead, we believe we may be entering a period during which active management proves its value again over passive management. This would be quite the opposite of what has transpired over the most recent decade.

Lastly, we note that there is a preponderance of surplus cash sitting on the sidelines or being allocated to illiquid asset classes such as private equity. We believe both are sub-optimal solutions given the opportunities available in long-only, liquid equity portfolios of well-chosen securities which we believe can outperform cash and inflation over the long term while avoiding the illiquidity and leverage traps of private equity as a category.

Portfolio Review:

Conscious Investment Ideas

In 2025, Davis Large Cap Value SMA returned +21.65%, dramatically outperforming the Russell 1000 Value Index’s +15.91% return. As can be seen in the chart below, the Davis Large Cap Value SMA portfolio has outperformed its benchmark over the trailing 1-, 3-, 5-, 10-, 15-, 20-year and since inception periods.

The relative outperformance over many historical time periods reflects in our view the effectiveness of Davis Advisors’ distinct approach to value investing in both absolute and relative terms.

Significantly, our long-term results also speak to market dynamics which tend to change period by period. This means that the stock market generally offers us opportunities on a regular basis, either in broad swaths such as at the sector level or in individual situations where mispricing can occur. In this regard, the market’s volatility in any given year can be a friend to long-term investors looking for bargains. In fact, in Davis Advisors’ more than 56 years on Wall Street as an independent-minded research organization, there has never been a year that failed to offer us constructive ways to allocate capital, and we believe that the market’s inherent workings will continue to do so in the future.

As we enter this new year in 2026, we continue to apply the same time-tested investment discipline of buying durable businesses at value prices that explain our success historically. The businesses we favor have the potential to compound at attractive rates over the long term, based on our own research insights and financial analysis. In particular, we continuously seek ways to participate in the long-term success of competitively advantaged business models with superior earnings growth potential trading at a discount to the market.

To provide an overview of our current positioning, the table below summarizes the portfolio’s overall position in terms of risk and reward characteristics versus its benchmarks.

Selective, Attractive Growth, Undervalued2

| Portfolio | Russell 1000 Value Index | S&P 500 Index | |

|---|---|---|---|

| Holdings | 28 | 870 | 503 |

| EPS Growth (5 year) | 17.4% | 12.5% | 18.5% |

| P/E (Forward) | 15.2x | 20.0x | 26.2x |

As shown, Davis Large Cap Value SMA portfolio trades at a steep discount to the Russell 1000 Value Index yet the portfolio’s earnings per share growth rate over the last five years of over 17% is significantly higher than that of the index’s growth rate of under 13%.

In other words, we are offering a portfolio that is a relative bargain in our eyes versus its passive alternative while still benefiting from growth—characteristics that we find desirable in the broader equity universe.

What all our investments have in common are verifiable financial strength, experienced management teams and some form of what we believe are enduring competitive advantages.

Reviewing our relative successes in 2025, they were driven primarily by investments across a broad range of industries ranging from healthcare services and technology shares to financial services.

Within healthcare, we were very opportunistic throughout 2025 and the prior year, investing in a decisive way when shares of leading managed care insurers stumbled as operating costs surged rather unexpectedly for the group. Our key thesis was that these businesses were trading at low to very reasonable multiples on depressed earnings relative to historical levels, yet stood a good chance of recovering, possibly in dramatic fashion. Seemingly small margin improvements on low profit margins can translate into very large percentage increases in structural earnings power. We believe the market’s valuations for these portfolio companies underestimated the potential for a rebound in their bottom-line economics.

Outside of managed care investments currently in the portfolio, we also own certain leaders in generics (Viatris, for example) and lab and diagnostics services (Quest Diagnostics). We see good value in these holdings based on the view that healthcare spend in the U.S. is likely to continue expanding, increasing the addressable market opportunity for our healthcare names.

Our technology-driven holdings span companies in social media, online search, cloud computing and e-commerce. We own select positions within the Magnificent 7 but trimmed those positions based on valuation and size where appropriate throughout 2025.3 We also own semiconductor companies that we find attractive but do not trade at very high multiples. The latter group includes so-called “picks and shovels”—workhorse technology businesses with strong competitive positions in their respective end markets, a long track record of creating value for shareholders, and valuations that are at reasonable levels for the financial strength and expected growth rates we have built for them into our models.

Within financials, the portfolio looks quite different from any major passive index today. Our largest position by far is Capital One Financial. This entity has a strong consumer finance and credit card division, a deposit-rich bank that is growing share in the U.S., and the payment processing platform that it acquired with Discover Financial Services. Its economics look more attractive than certain widely owned technology companies yet it trades at only 13–14 times forward earnings, or a 7–8% earnings yield (forward earnings per share divided by current price and distinguishable from dividend yield). Capital One Financial is also the fifth-largest holder of AI-related patents among major U.S. companies. This is an advantage that we believe is in the early stages of transforming an already highly profitable business model into a far more profitable one.

“Capital One Financial’s economics look more attractive than certain widely owned technology companies yet it trades at only 13–14 times forward earnings, or a 7–8% earnings yield.”

Markel, another financial holding that is under-represented in the passive indexes, is an example of a select turnaround situation in the portfolio.

Elsewhere in the portfolio we hold several rather unique special situations. One of these is a gaming and resorts company which owns a large share of the Las Vegas strip’s real estate as well as having interests in casino properties in Macau and Osaka, Japan. It also holds interests in online betting platforms. The company’s forward P/E is in the low double-digits on our estimates. This valuation level essentially gives investors the chance to own the core business without paying much for the Asian operations or the online betting assets. It is a contrarian idea but one in which we have high conviction based on our analysis.

We also own stakes in companies that we have been quietly building in the areas of energy and commodities.

In summary, our track record of beating the Russell 1000 Value Index over the 1-, 3-, 5-, 10-, 15-, 20-year and since inception periods points is not coincidental in our view. It reflects a repeatable, consistent effective investment discipline at Davis Advisors that we have employed for over five decades. We believe that if history is any guide, the market will continue to function in such a way as to serve us well in future periods and we look forward to those opportunities.

Outlook:

Rational Risk and Reward

For investors who recognize today’s potential valuation bubble in the S&P 500 Index and to some extent in the slower-growing Russell 1000 Value Index, Davis Large Cap Value SMA represents an opportunity to navigate the current market environment in a thoughtful way.

We believe in the prudence of maintaining a rational balance of risk and reward factors, not only at the individual security level but also in how we arrange portfolio sectors and weightings. This is in sharp contrast to the unmanaged indexes, where security and sector weightings are determined largely by share price momentum.

We also believe that surplus cash sitting on the sidelines should be revisited in the new year given the likelihood of falling interest rates and the relatively more attractive total return potential of well-chosen equities.

Together on This Journey

For more than 50 years, Davis Advisors has navigated a constantly changing investment landscape guided by one North Star: to grow the value of the funds entrusted to us. We are pleased to have achieved strong results thus far and look forward to the decades ahead. With more than $2 billion of our own money invested in our portfolios, we stand shoulder to shoulder with our clients on this long journey.4 We are grateful for your trust and are well-positioned for the future.

Inception of Russell 1000 Value Index is 1/1/02.

Five-year EPS Growth Rate (5-year EPS) is the average annualized earnings per share growth for a company over the past 5 years. The values shown are the weighted average of the 5-year EPS of the stocks in the Portfolio or Index. Approximately 2.30% of the assets of the Portfolio are not accounted for in the calculation of 5-year EPS as relevant information on certain companies is not available to the Advisors’ data provider. Forward Price/Earnings (Forward P/E) Ratio is a stock’s price at the date indicated divided by the company’s forecasted earnings for the following 12 months based on estimates provided by the Portfolio’s data provider. These values for both the Portfolio and the Index are the weighted average of the stocks in the portfolio or Index.

The “Magnificent 7” is a group of seven dominant, high-performing U.S. technology companies that have a significant influence on the stock market. The companies that make up the Magnificent 7, along with their stock tickers, are: Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla.

As of 12/31/25, Davis Advisors, the Davis family and Foundation, and our employees have more than $2 billion invested alongside clients in similarly managed accounts and strategies.

This material may be shared with existing and potential clients to provide information concerning market conditions and the investment strategies and techniques used by Davis Advisors to manage its client accounts. Please refer to Davis Advisors Form ADV Part 2 for more information regarding investment strategies, risks, fees, and expenses. Clients should also review other relevant material, including a schedule of investments listing securities held in their account.

*As of 12/31/25. Includes Davis Advisors, Davis family and Foundation, and our employees. †The Attractive Growth and Undervalued reference in this piece relates to underlying characteristics of the portfolio holdings. There is no guarantee that the Portfolio’s performance will be positive as equity markets are volatile and an investor may lose money. Past performance is not a guarantee of future returns. Five-year EPS Growth Rate (5-year EPS) is the average annualized earnings per share growth for a company over the past 5 years. The values shown are the weighted average of the 5-year EPS of the stocks in the Portfolio or Index. The 5-year EPS of the S&P 500 is 18.5%. Approximately 2.30% of the assets of the Portfolio are not accounted for in the calculation of 5-year EPS as relevant information on certain companies is not available to the Portfolio’s data provider. Forward Price/Earnings (Forward P/E) Ratio is a stock’s price at the date indicated divided by the company’s forecasted earnings for the following 12 months based on estimates provided by the Advisor’s data provider. These values for both the Portfolio and the Index are the weighted average of the stocks in the Portfolio or Index. The Forward P/E of the S&P 500 is 26.2x. ‡For information purposes only. Not a recommendation to buy or sell any security. **Sources: Davis Advisors and Clearwater Wilshire Atlas.

The investment strategies described herein are those of Davis Advisors. These materials are being provided for illustrative and informational purposes only. The information contained herein is obtained from multiple sources that are believed to be reliable. However, such information has not been verified, and may be different from the information included in documents and materials created by the sponsor firm in whose investment program a client participates. Some sponsor firms may require that these materials are preceded or accompanied by investment profiles or other documents or materials prepared by such sponsor firms, which will be provided upon a client’s request. For additional information, documents and/or materials, please speak to your Financial Advisor.

The performance of mutual funds is included in the Composite. The performance of the mutual funds and other Davis managed accounts may be materially different. For example, the Davis New York Venture Fund may be significantly larger than another Davis managed account and may be managed with a view toward different client needs and considerations. The differences that may affect investment performance include, but are not limited to: the timing of cash deposits and withdrawals, the possibility that Davis Advisors may not buy or sell a given security on behalf of all clients pursuing similar strategies, the price and timing differences when buying or selling securities, the size of the account, the differences in expenses and other fees, and the clients pursuing similar investment strategies but imposing different investment restrictions. This is not a solicitation to invest in the Davis New York Venture Fund or any other fund.

Davis Advisors is committed to communicating with our investment partners as candidly as possible because we believe our clients benefit from understanding our investment philosophy and approach. Our views and opinions include “forward-looking statements” which may or may not be accurate over the long term. Forward-looking statements can be identified by words like “believe,” “expect,” “anticipate,” or similar expressions. You should not place undue reliance on forward-looking statements, which are current as of the date of this material. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. While we believe we have a reasonable basis for our appraisals and we have confidence in our opinions, actual results may differ materially from those we anticipate.

Returns from inception (4/1/69) through 12/31/01, were calculated from the Davis Large Cap Value Composite (see description below). Returns from 1/1/02, through the date of this material were calculated from the Large Cap Value (SMA) Composite.

Davis Advisors’ Large Cap Value Composite includes all actual, fee-paying, discretionary Large Cap Value investing style institutional accounts, mutual funds, and wrap accounts under management including those accounts no longer managed. Effective 1/1/98, a minimum account size of $3,500,000 was established. Accounts below this minimum are deemed not to be representative of the Composite’s intended strategy and as such are not included in the Composite. A time-weighted internal rate of return formula is used to calculate performance for the accounts included in the Composite.

Davis Advisors’ Large Cap Value (SMA) Composite excludes institutional accounts and mutual funds. Performance shown from 1/1/02, through 12/31/10, includes all eligible wrap accounts with a minimum account size of $3,500,000 from inception date for the first full month of account management and includes closed accounts through the last day of the month prior to the account’s closing. For the performance shown from 1/1/11, through the date of this material, the Davis Advisors’ Large Cap Value SMA Composite includes all eligible wrap accounts with no account minimum from inception date for the first full month of account management and includes closed accounts through the last day of the month prior to the account’s closing. The net of fees rate of return formula used by the wrap-fee style accounts is calculated based on a hypothetical 3% maximum wrap fee charged by the wrap account sponsor for all account service, including advisory fees for the period 1/1/06, and thereafter. For the gross performance results, custodian fees and advisory fees are treated as cash withdrawals. A list of Davis Advisors’ Composites is available upon request.

This material discusses companies in conformance with Rule 206(4)–1 of the Investment Advisers Act of 1940 and guidance published thereunder. Six companies are discussed and are chosen as follows: (1–4) current holdings based on December 31 holdings; (5) the first new position; and (6) the first position that is completely closed out. Starting at the beginning of the year, the holdings from a Large-Cap Value model portfolio are listed in descending order based on percentage owned. Companies that reflect different weights are then selected. For the first quarter, holdings numbered 1, 6, 11, and 16 are selected and discussed. For the second quarter, holdings numbered 2, 7, 12, and 17 are selected and discussed. This pattern then repeats itself for the following quarters. If a holding is no longer in the portfolio then the next holding listed is discussed. No more than two of these holdings can come from the same sector per piece. None of these holdings can be discussed if they were discussed in the previous three quarters. If there were no purchases or sales, the purchases and sales are omitted from the material. If there were multiple purchases and/or sales, the purchase and sale discussed shall be the earliest to occur. As this is primarily a domestic equity strategy, no more than one foreign holding will be discussed in any material. If more than one foreign holding would be discussed based on the criteria above, the holding with the largest percent of assets in the model portfolio would be chosen. However, if the model portfolio has an aggregate foreign holding percentage that is greater than 15% the commentary would include a discussion of the largest foreign holding in the model portfolio that has not been discussed in the previous three quarters. Other than the recent buy and sell, any company discussed must constitute at least 1% of the portfolio as of December 31.

The information provided in this material does not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to buy or sell any particular security. There is no assurance that any of the securities discussed herein will remain in an account at the time this material is received or that securities sold have not been repurchased. The securities discussed do not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of any account’s portfolio holdings. It should not be assumed that any of the securities discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein. It is possible that a security was profitable over the previous five year period of time but was not profitable over the last year. In order to determine if a certain security added value to a specific portfolio, it is important to take into consideration at what time that security was added to that specific portfolio. A complete listing of all securities purchased or sold in an account, including the date and execution prices, is available upon request.

The investment objective of a Davis Large Cap Value account is long-term growth of capital. There can be no assurance that Davis will achieve its objective. Davis Advisors uses the Davis Investment Discipline to invest a client’s assets principally in common stocks (including indirect holdings of common stock through depositary receipts) issued by large companies with market capitalizations of at least $10 billion. Historically, the Large-Cap Value strategy has invested a significant portion of its assets in financial services companies and in foreign companies, and may also invest in mid- and small-capitalization companies. The principal risks are: China risk, common stock risk, depositary receipts risk, emerging market risk, fees and expenses risk, financial services risk, focused portfolio risk, foreign country risk, foreign currency risk, headline risk, large-capitalization companies risk, manager risk, mid- and small-capitalization companies risk, and stock market risk. See the ADV Part 2 for a description of these principal risks.

The attractive growth reference in this material relates to underlying characteristics of the portfolio holdings. There is no guarantee that the portfolio performance will be positive as equity markets are volatile and an investor may lose money.

We gather our index data from a combination of reputable sources, including, but not limited to, Clearwater Wilshire Atlas, Lipper, and index websites.

The S&P 500 Index is an unmanaged index that covers 500 leading companies and captures approximately 80% coverage of available market capitalization. The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values. The Russell 1000 Value Index is constructed to provide a comprehensive and unbiased barometer for the large-cap value segment. Investments cannot be made directly in an index.

Item #3894 12/25 Davis Advisors, 2949 East Elvira Road, Suite 101, Tucson, AZ 85756 800-717-3477, davisadvisors.com

Large Cap Value SMA Portfolio

Winter Update 2026