Video Filters

Mastering the Mental Game of Investing

A video series to help you develop the mindset of a successful investor.

Watch the Series31 Videos

Investing through Volatility

PM Chris Davis on developing a mindset that allows you to tune out the daily drama and successfully build wealth.

Positioning for a Market in Transition

PM Chris Davis on Today's Markets and Davis LCV SMA

2025 Message on the Markets and Davis Large Cap SMA

PM Chris Davis on the big technological and market transitions unfolding – and the advantages our investment discipline has in this environment

The Most Important Things We Believe Equity Investors Should Focus on Today (6:07)

Why we believe selectivity is more important in a time of great market and economic transition and highs in both market concentration and valuations

Rigorous Research & Selectivity are Critical in Today’s Market (2:18)

Why we’re focused intently on identifying resilient companies with above average growth prospects - and not overpaying

The Attributes We Believe Investors Should Seek When Selecting an Investment Manager (2:30)

Look for the same characteristics in an investment manager that you'd look for in a company: a track record of execution, resilience, adaptability to change

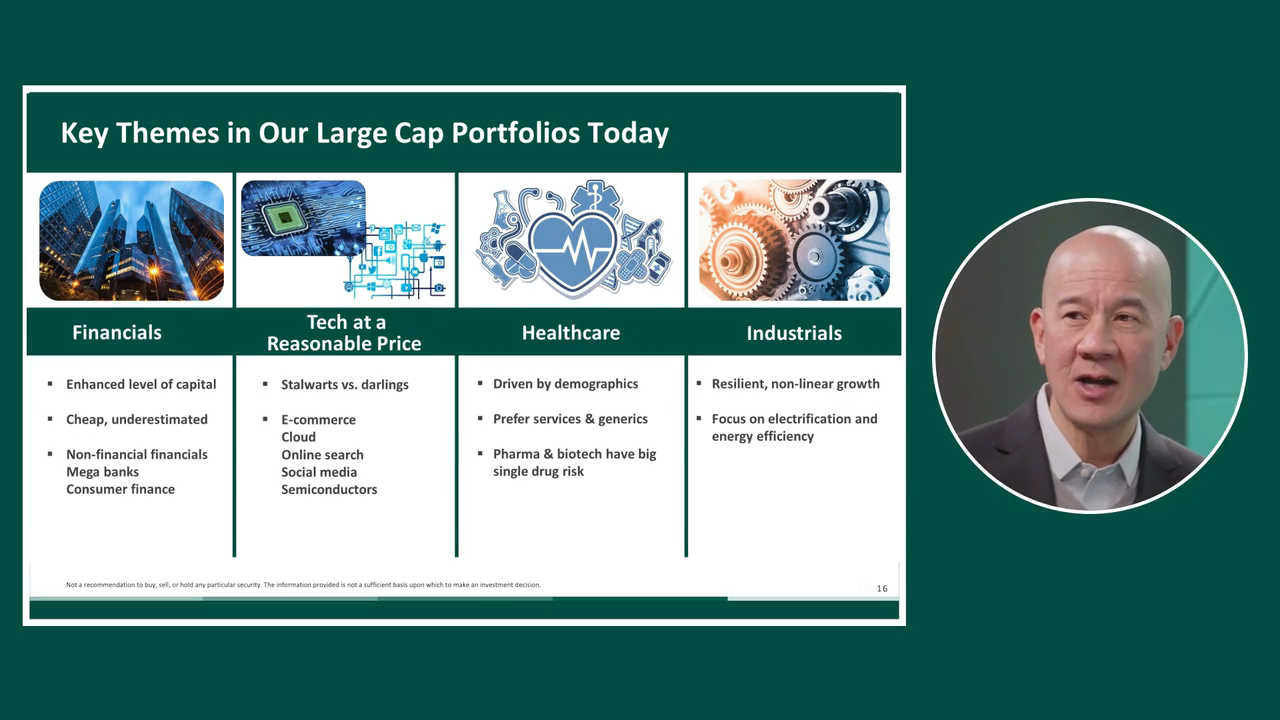

Investment Themes in the Portfolio Today (1:58)

Why we see tailwinds and opportunities across Financials, Tech, Healthcare and Industrials

The Danger of Overly Aggressive Growth Assumptions (1:39)

Why investors often overpay for the inflated growth projections of today's high flyers - taking on risk in the areas they see as safe

Undervalued & Underappreciated – The Opportunity Today in Select Financials (3:58)

Why the best-run Financials continue to be significantly undervalued, as investors misunderstand their durability and earnings power

Separating Hype from Opportunity – Investment Implications of AI (4:04)

How we're thinking through transformational growth opportunities, along with the risk of the over-hyped companies and soon-to-be obsoleted business models

“Hey ChatGPT – Finish this Building…Oh Wait!” Opportunities in the Industrial Sector (1:54)

Don't forget opportunities in the real physical world of commodities, agriculture and building products, far from today's over-hyped story stocks

Predicting vs. Preparing, Navigating Sticky Inflation & High Valuations (4:21)

In a world of significant transformation, it's not about risk on / risk off. It's about aligning with durable, adaptable, growing businesses and not overpaying

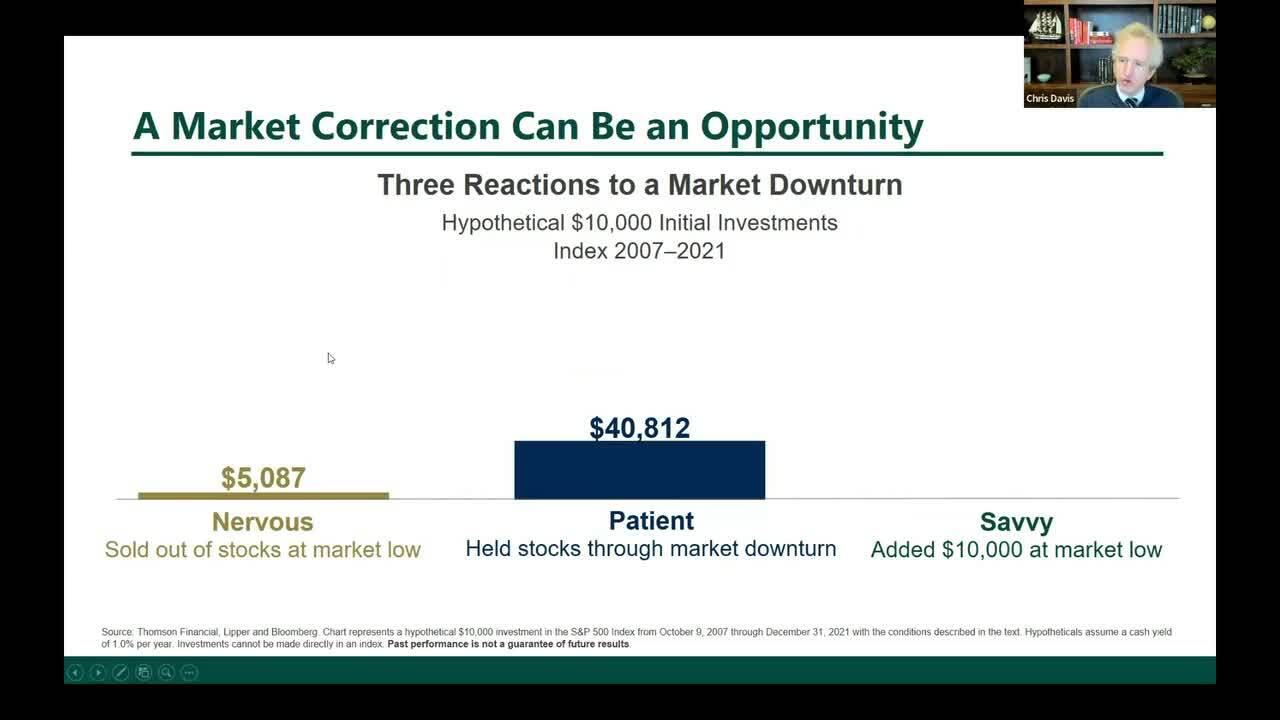

Strategies to Mitigate the Investor Behavior Penalty (3:45)

The most common and damaging investor penalty comes from rushing in at euphoric high prices and panic selling at the lows. Here's a real alternative.

Chris Davis on a Portfolio Well Suited to a Market in Transition

The Davis Large Cap Portfolio is benefitting as investors refocus on business fundamentals, growth and valuations – and remains significantly undervalued despite its attractive recent returns.

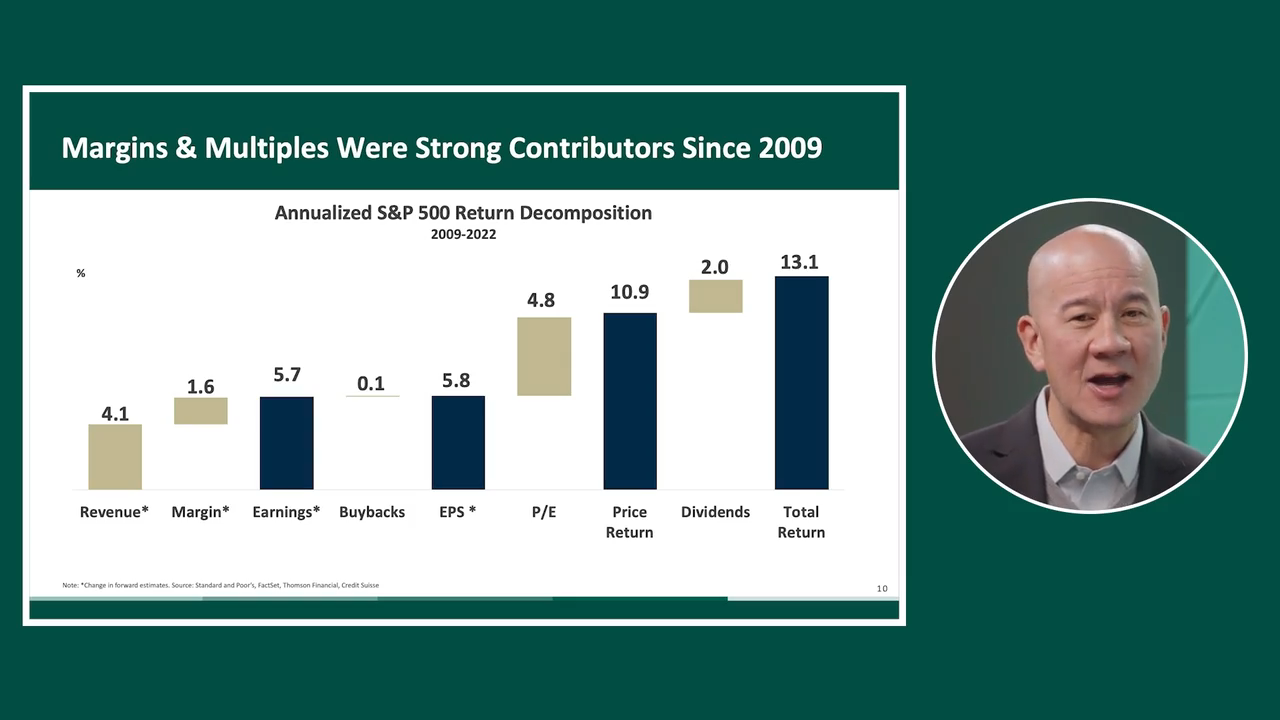

Rising Multiples Carried the Markets through the “Easy Money” Decade. What’s Next?

With normalizing rates, companies will need to earn their higher valuations. Find lower-multiple companies with sustainable and growing margins.

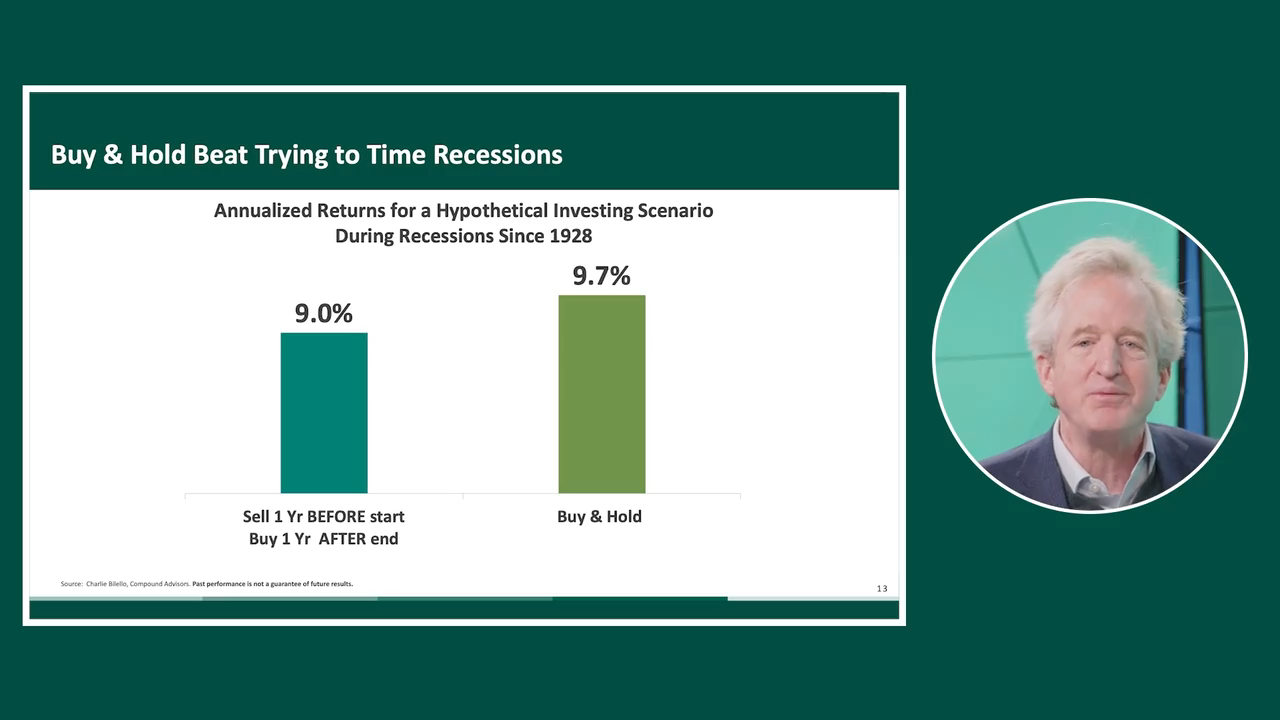

Recession Coming? Timing Investment Decisions to Predictions is a Loser’s Game

Buy and hold regularly outperforms guessing the timing of the next recession. Align with companies that can ride out the storms.

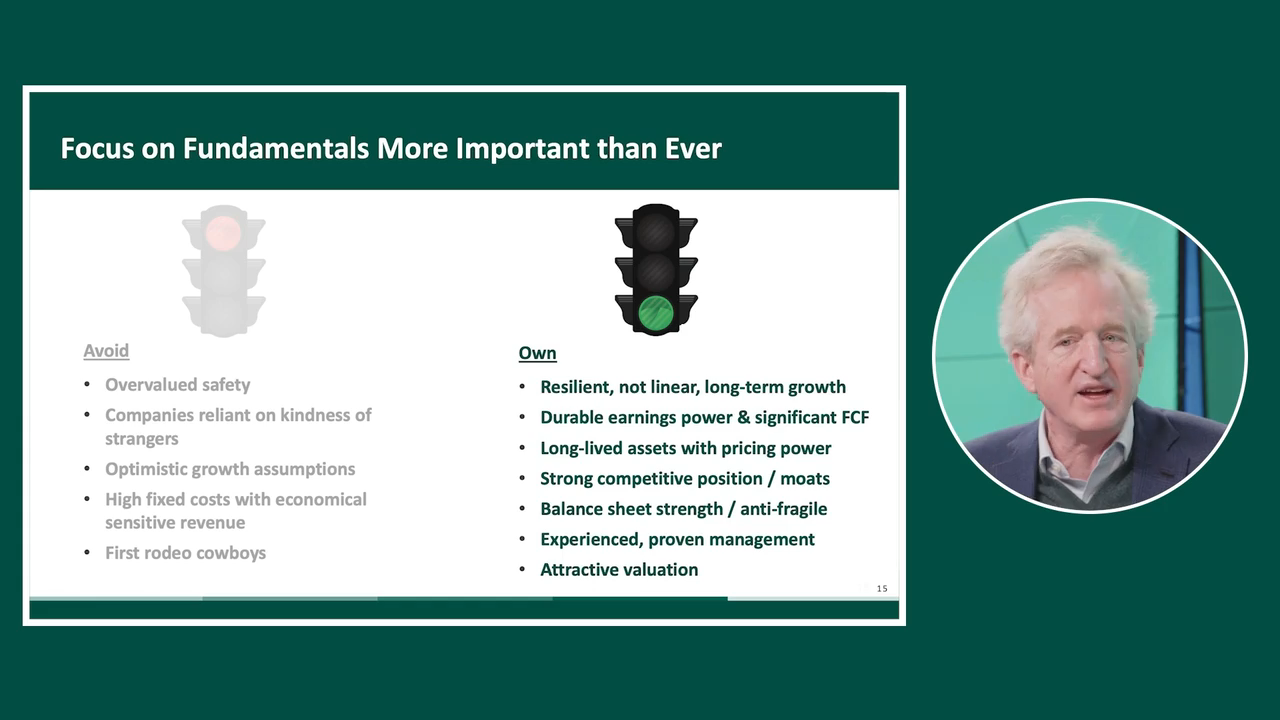

What to Own and Avoid in a Changing Environment

As rates normalize, specific companies attributes may be rewarded or penalized by the markets

How does the Current Market Compare to Others?

Examples when attractive stock-picking opportunities could be found in otherwise expensive markets

Investment Themes We’re Focusing On Today.

Why we’re focusing on select opportunities within Financials, Tech at a reasonable price, Healthcare and Industrials

The Return to Rationality

The bursting of the easy money bubble marks a huge transition for the markets

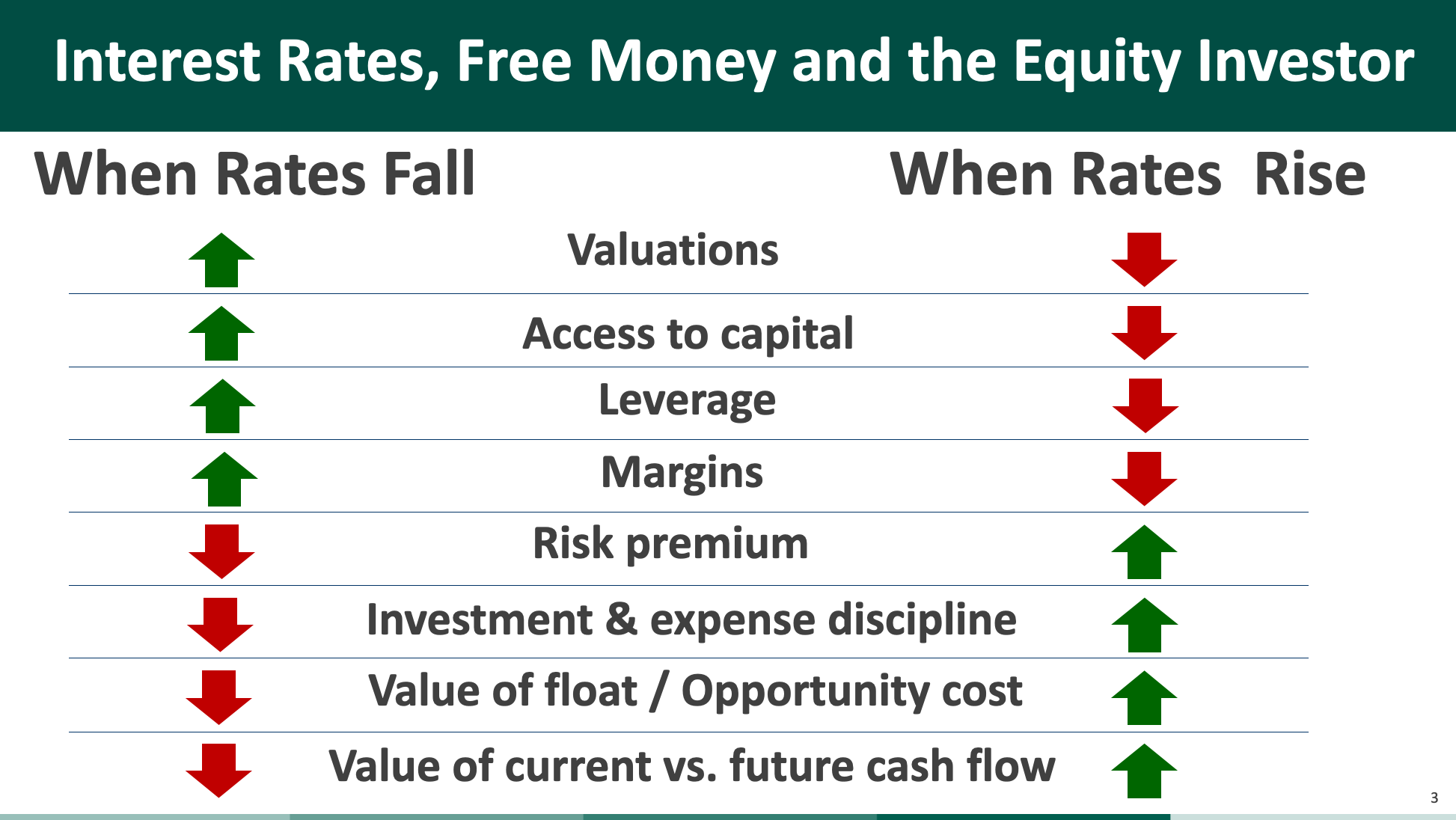

Investor Implications of Rising Rates

How the end of the free money era is ending the distortions of the past decade and returning rationality to the markets

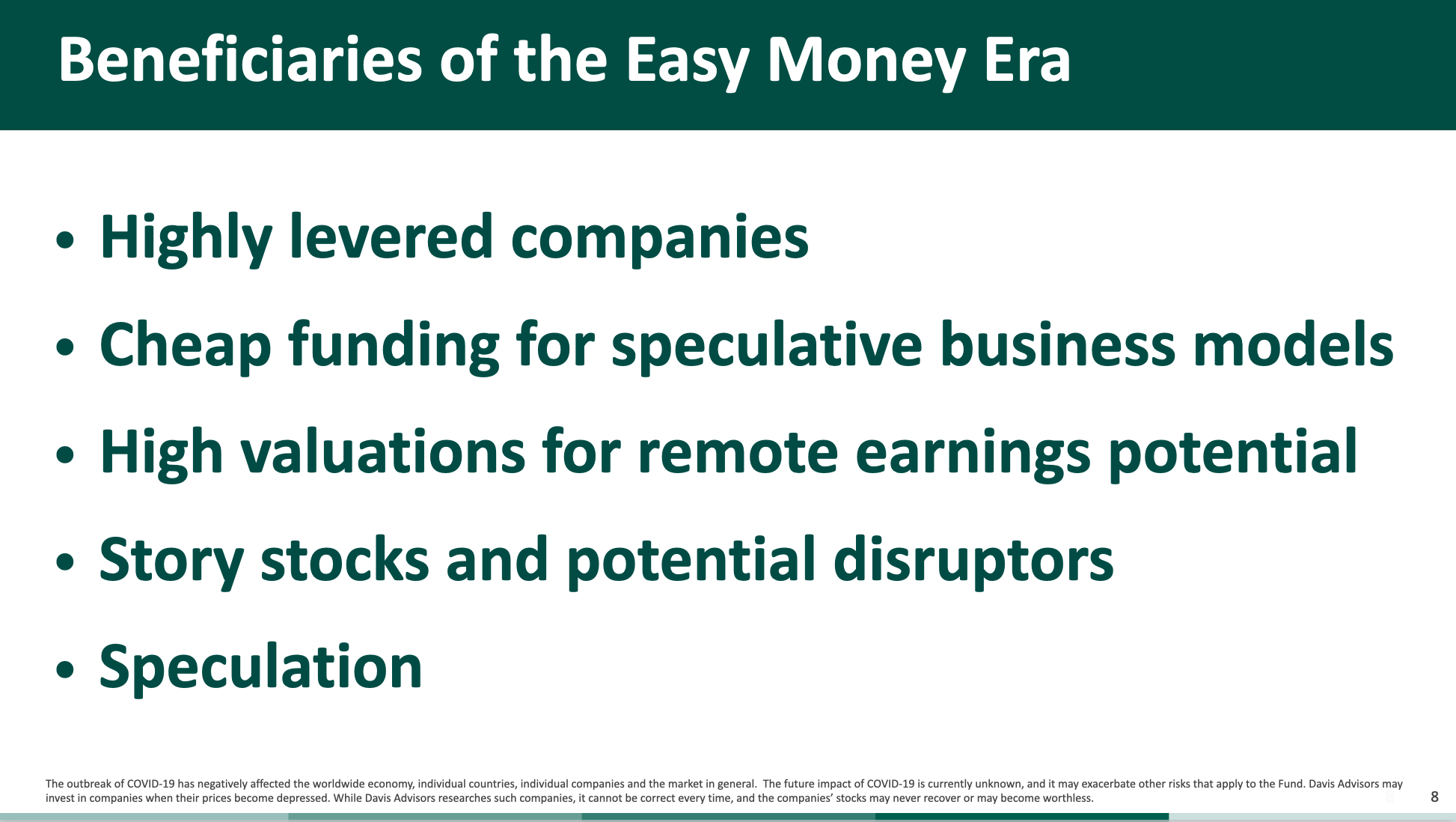

The Easy Money Era – Who Was Helped

The long period of low interest rate fueled a bubble, creating widespread market distortions and irrational valuations

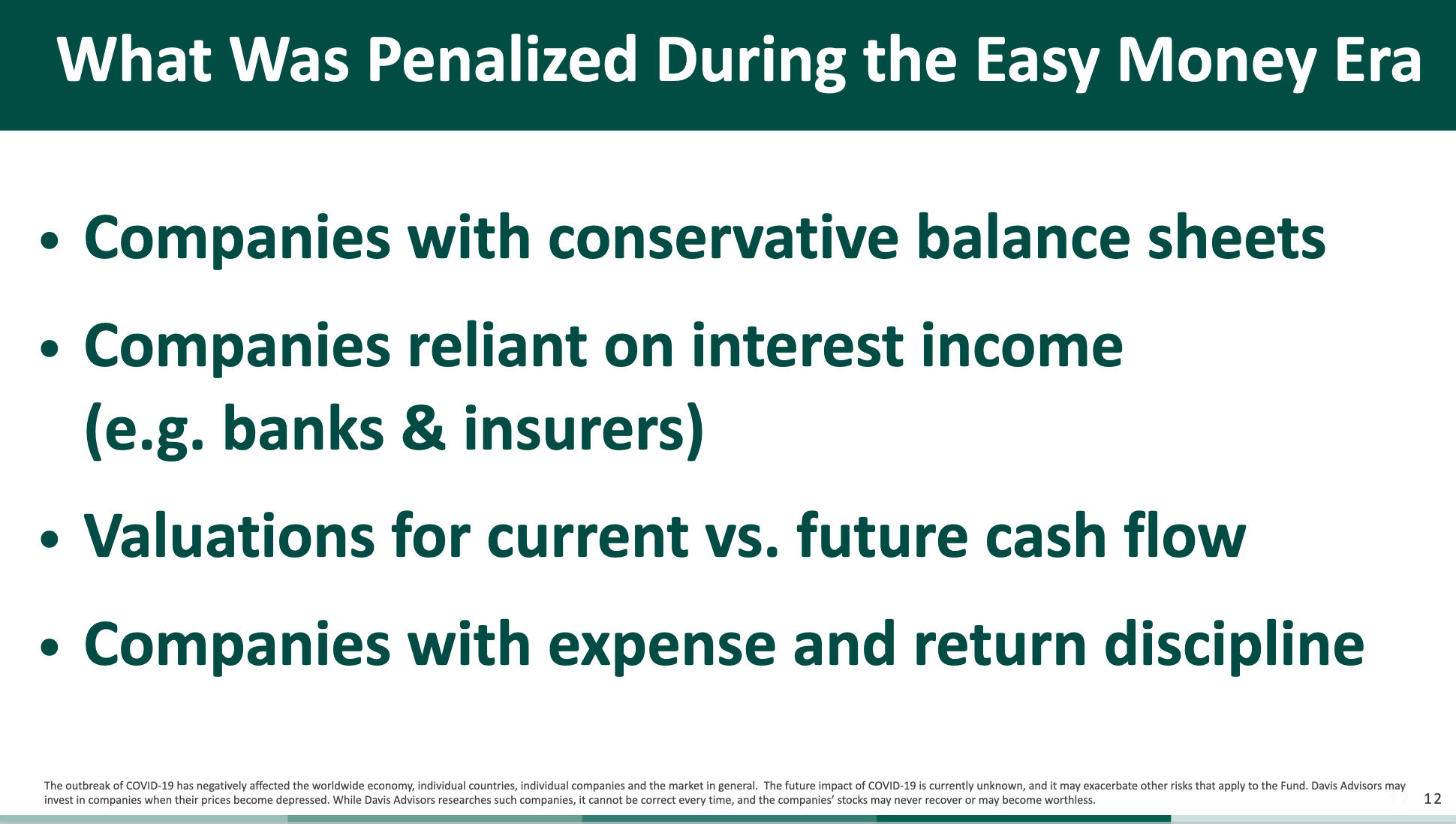

The Easy Money Era – Who Was Hurt

The long period of low interest rates punished companies who were succeeding by traditional measures

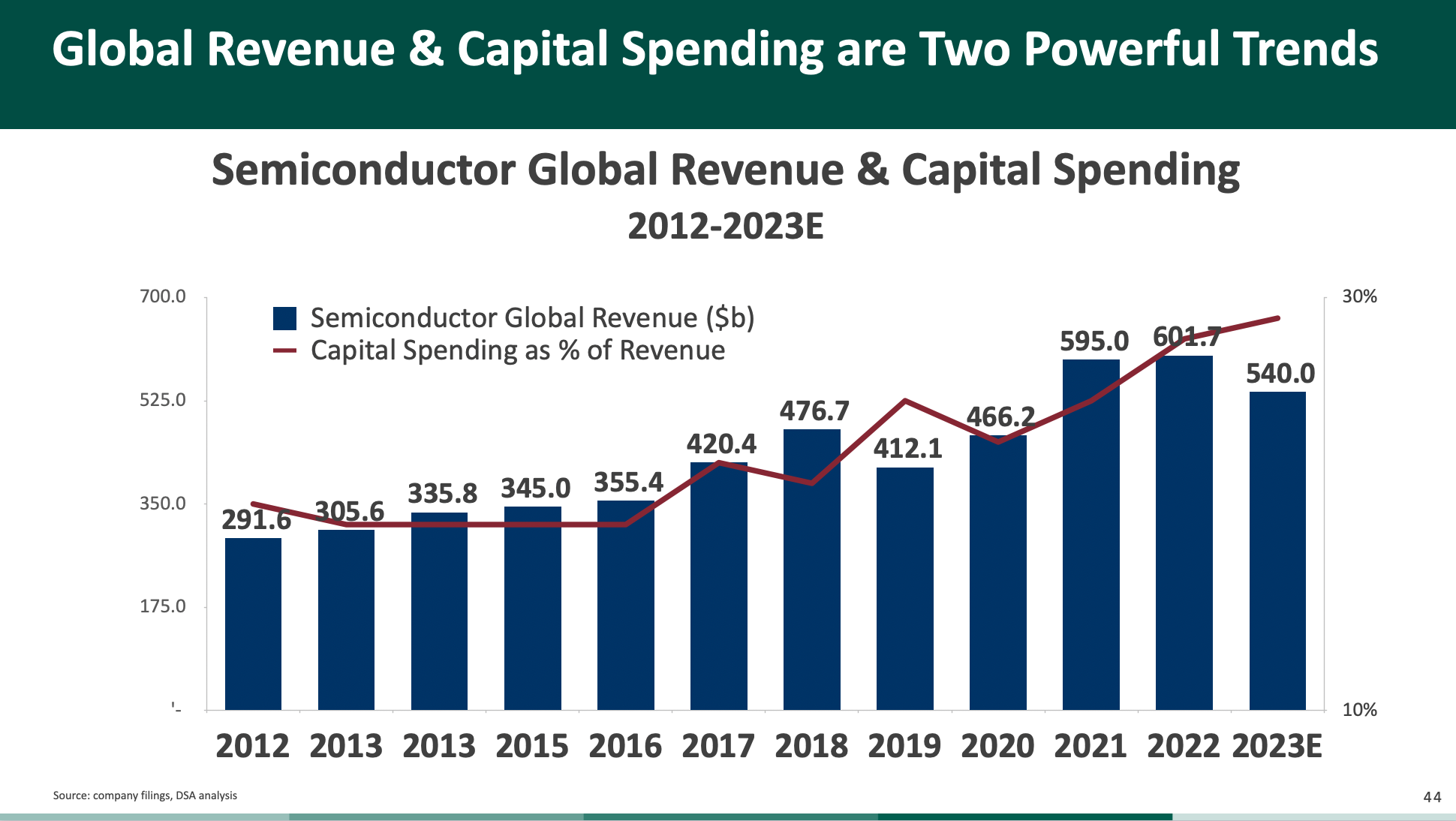

The Opportunity in Semi-Conductors

The huge, long-term tailwinds driving Semiconductor growth

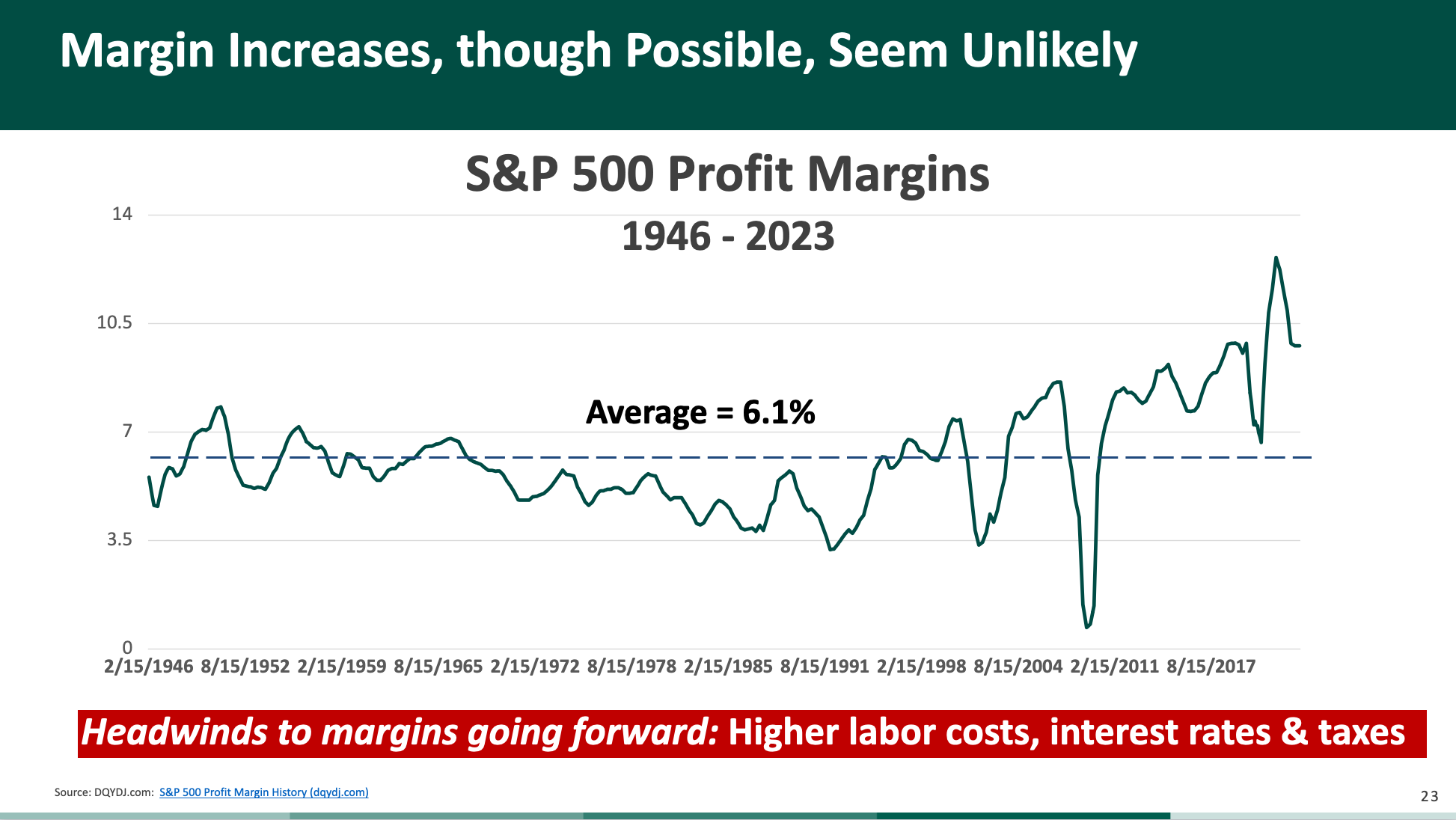

Navigating Headwinds with Active Management

The ever-expanding margins and valuations of the past decade are unlikely to be sustained

How Investors Should Prepare for the End of the “Easy Money” Era

As rates normalize, certain business models are going to be severely challenged. What kind of companies do you want to own?

Volatility is the Price of Admission for Long-Term Returns

To benefit from the wealth-building potential of equities, investors need to understand that pullbacks and drama will be an inevitable part of the journey.

Equities Role During Periods of Inflation

How inflation quietly eats away at the purchasing power of consumers and how Equities – while volatile in the short term – can help investors build long-term wealth faster than inflation can degrade it

Recession Potential and Impact on Portfolio Positioning

Predicting is futile. Buy businesses that have proven resilient through the inevitable storms. Investors are now being reminded of the critical importance of the business durability.

The Incredible Value Advisors Can Add During Volatile Markets

How the guidance of a financial advisor can help investors successfully build wealth as they navigate inevitable market volatility.

Tuning out the Tweets

The most important lessons on successfully compounding wealth from our 50 years in the equity markets